Solar panels in Massachusetts can help homeowners save a lot of money. The average residential energy bill rises by 3% per year, which can add up quickly. Extreme weather can increase energy costs further. Because of this, solar panels are becoming an increasingly popular energy source in the state.

Massachusetts' average price for solar panels

The cost of solar panels in Massachusetts is variable depending on how big your home is and what type of equipment you need. In Massachusetts, however, solar installation costs range from $10,007 up to $15,395. You can expect to spend between $10,007 and $15,395. If you have a small house, you could expect to pay as low as $7,000. However, if you have a larger home, solar panels can cost up to $55,953.

Massachusetts has the lowest cost of solar power installation. According to the Environment Massachusetts Research and Policy Center (including tax credits and incentives), a typical 5 kW solar system costs between $9,300 and $11,000. Although solar panels can cost a lot, they are relatively inexpensive and can help you save up to $40786 over the 20-year period.

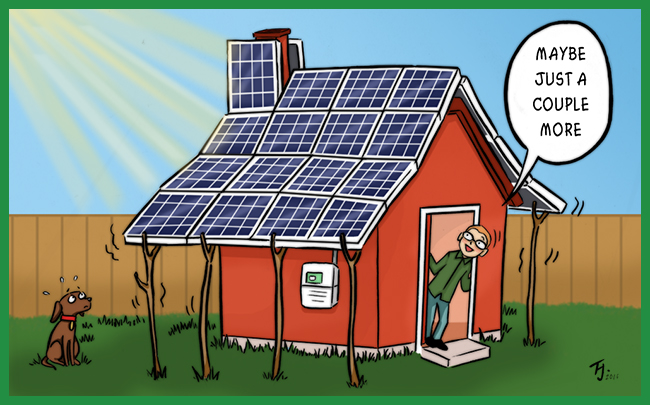

Mounting solar panels on the roof is the best way to go in Massachusetts. Some homes may not have their solar panels facing south or may be too shaded. You will need to find alternative mounting options in these situations.

Massachusetts Tax Credits for Installing Solar Panels

If you're considering installing solar panels on your home, Massachusetts has an incentive program for you. Under the SMART program, Massachusetts offers a 15% tax credit for the installation of solar panels on your home. The credit can be carried forward for three years. The program is intended for encouraging solar installation. It is funded annually by the three main utilities of the state: Eversource Unitil and National Grid.

Not only will solar panels increase the home's worth, but they will also give you a 15% tax credit for installation costs. The credit can be used to cover up to $1,000 in installation costs. Additionally, solar installations are exempt from sales tax and property taxes. This means that your property taxes will not go up and your sales tax will not be assessed in the first year. Massachusetts also has a localized solar program.

Three types of tax credits are available to Massachusetts residents for installing solar panels. Massachusetts residents have the opportunity to earn a fixed rate for solar panels that produce 19 cents per kWh over a 10-year period through the SMART Program. To qualify, your system should be connected to at least one of the three investor-owned utilities. The availability of rebates will depend on the type of system you install.

Off-grid solar panels in Massachusetts

The cost of Massachusetts off-grid solar panel installation depends on several factors. Massachusetts also offers several incentives, including a sale tax exemption and property tax exemption, for solar panel installation. A tax credit of up $1,000 is available by the state, and Massachusetts solar customers are eligible for the federal 30 percent tax credit until 2022.

Massachusetts permits homeowners with solar panels to be installed on their roofs. However there are restrictions that apply to specific neighborhoods and homeowner's organizations. Association boards may have to approve solar panel installation. These rules can be set by neighborhood associations. Your association board might also request that you hide or reduce your solar panels.

Massachusetts residents have the opportunity to take advantage of net-metering, which allows customers to sell excess electricity back into the grid to receive credits towards their utility bills. The utility company will store the credits and apply them to your bill, lowering your bill. These credits are available to offset excess electricity or retail electricity.